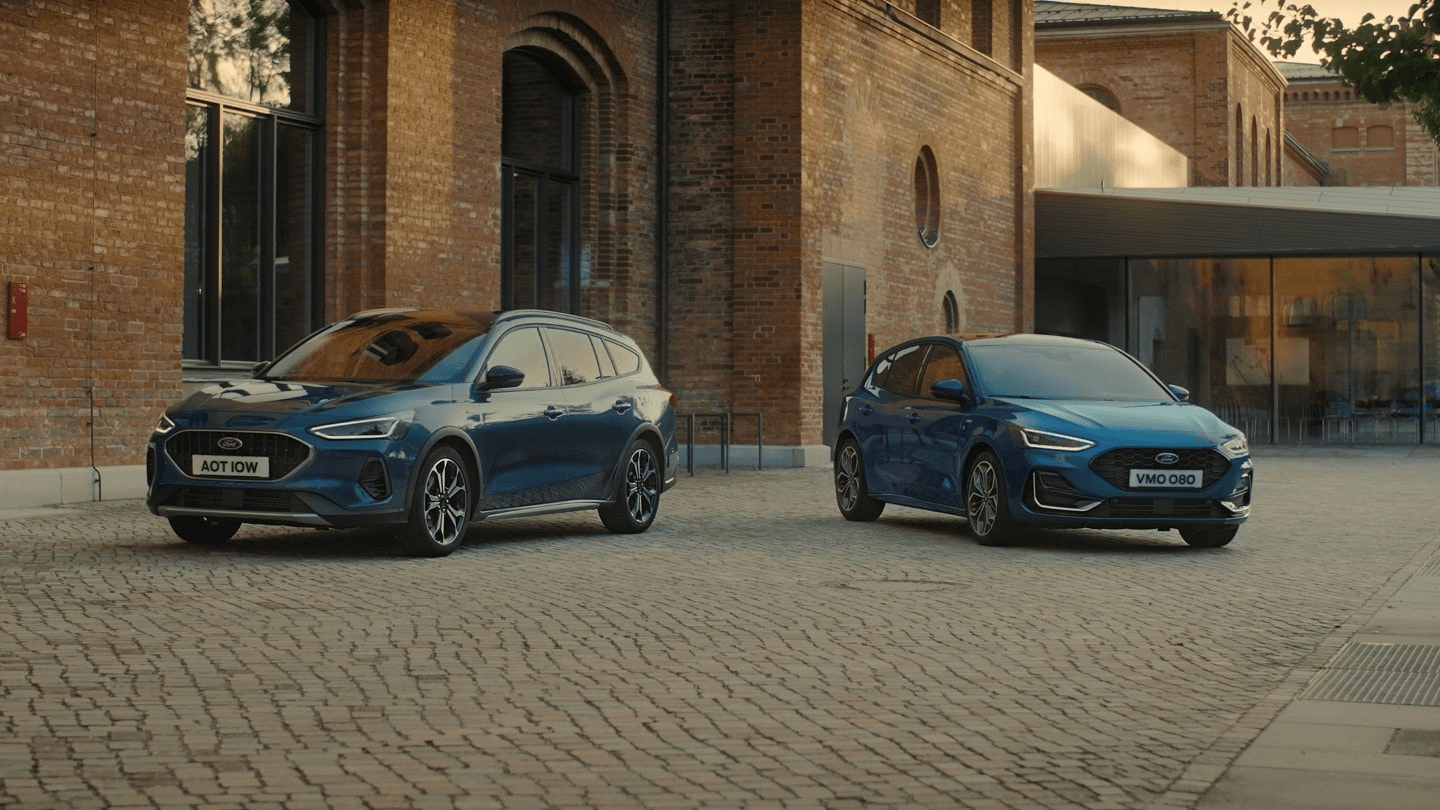

From the new Ford Puma through to the ever-popular Ford Kuga PHEV or the next generation Fully Electric Ford Explorer. Our range includes a great choice of vehicles to suit every need.

Our new car finance packages offered via Ford Credit are equally flexible, offering you different ways to finance your new car purchase based on your personal circumstances.

A type of hire purchase (sometimes called Personal Contract Purchase or simply PCP) with an Optional Final Payment and three end of contract options:

(1) Renew - part exchange the vehicle.

(2) Retain - pay the Optional Final Payment to own the vehicle.

(3) Return the vehicle - further charges may be made subject to condition/mileage.

Pay a deposit followed by monthly payments - you own the car at the end of the agreement.

Regardless of which on the new Transit range you are choosing for your business, our new commercial vehicle finance package, powered by Ford Pro Credit, offer a range of flexible options tailored specifically to business users.

We understand that every customer has different needs, just like every used vehicle we have in stock! That's why we offer a variety of used vehicle financing options to help you find a payment plan that fits your budget and lifestyle.

We cover four counties, supporting private and business drivers throughout UK.

Find a dealer